reit tax benefits ireland

125 corporation tax rate on active business income. There are limits on the ownership and transferability of Brookfield REITs shares.

How Our Tax System Rewards Foreign Investors In Irish Property

Which Ireland has a double taxation agreement DTA or treaty may be able to reclaim some of the DWT if the relevant tax treaty permits.

. The main tax incentives in Ireland are. Form 1099-DIV is issued to persons who have been recieved dividends and other distributions valued at 10 or more in money or other property. Irish REITs will be listed on the main market of a recognised stock exchange in an EU member state and should have the effect of attracting fresh capital into the Irish property market and thus improve further the stability of.

Thus in general a REIT owes no federal income tax if its dividends paid are at least equal to its taxable income. Investors in the top tax bracket can potentially see their tax bill for dividends go. Ad Learn the basics of REITs before you invest any of your 500K retirement savings.

Guidance on the treatment of expenses incurred. Get your free copy of The Definitive Guide to Retirement Income. Where shares in a REIT are held by an investment undertaking that investment undertaking may be an IREF - TDM Part 27-01b-02 refers.

They are generally exempt from Corporation Tax CT on income from their property rental business only. REITs offer investors the benefits of. Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025.

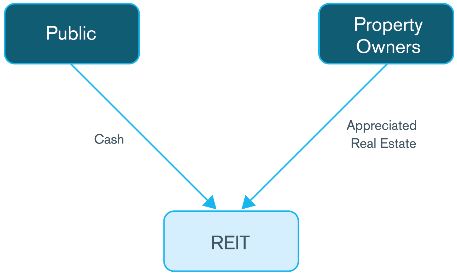

A Real Estate Investment Trust REIT is a company that directly invests in income-producing real estate either owning or managing the properties themselves. Also they are generally exempt from chargeable gains made on the disposal of assets of their property rental business only. REITs are partial conduits because unlike corporations in general REITs may deduct dividends paid in determining taxable income.

To eliminate the double layer of taxation that typically hinders the holding of property through a company a REIT is exempt from corporation tax on qualifying profits from rental property. Shareholders who fall into the highest income tax bracket currently 37 will pay 20 for long-term capital gains. Dividend income is taxed in the state s of residency regardless of where the.

In Ireland this requirement is set at 85 of rental profits. REITs have historically provided investors dividend-based income competitive market performance transparency liquidity inflation protection and portfolio diversification. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

A REIT is structured to provide after-tax returns to investors similar to direct. Borrowing also increases the risk of loss and exposure to negative economic effects. The aim of a REIT is to provide an after-tax return for investors similar to that of direct diversification.

For the low level of applications of investors choosing the REIT investment route is a general lack of awareness of the benefits of Irish REITs as an immigration investment option. Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors. Preferred shares in addition to five.

Conditions for REIT status. The idea is to shift tax liabilities on to shareholders who must by law receive at least 85 per cent of a Reits. Or group of connected persons can control the REIT.

Total effective tax deduction of 375. The pass-through deduction allows REIT investors to deduct up to 20 of their dividends. Real Estate Investment Trusts REITs are recognised as important vehicles for property investment in over 30 jurisdictions throughout the world.

Instead the company is required to distribute the vast majority of its profits 85 to its investors each year. In ideal vehicle for holding existing real estate investments including those outside Ireland subject to tax planning considerations at the level of the investment. Irish resident shareholders in a REIT will be liable to income tax on income distributions from the REIT plus PRSI and USC.

A REITs shareholders are taxed on dividends received from the REIT. A REIT is a real estate investment trust and it is essentially a company that owns operates or finances income-producing real estate. Irish resident investors will be liable to capital gains tax at a rate of 33 on a disposal of shares in the REIT.

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. Instead the company is required to distribute the vast majority of its profits to. REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock.

The updates in the Tax and Duty Manual 05-02-13 PDF 157 KB include the following. Annual Statement section 705M. A REIT is exempt from corporation tax on qualifying income and gains from rental property subject to a high profit distribution requirement to shareholders.

Reits were also in. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while those in all but the highest income bracket will pay 15. Irish Revenue has published updated guidelines concerning the tax treatment of expenses and benefits for certain workers who are working remotely e-workers in response to the coronavirus COVID-19 pandemic.

If the REIT held the property for more than one year long-term capital gains rates apply. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Irish resident corporate investors will be liable to 25 corporate tax on such distributions.

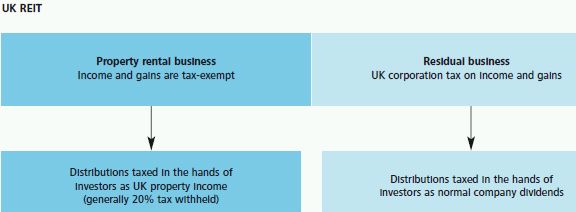

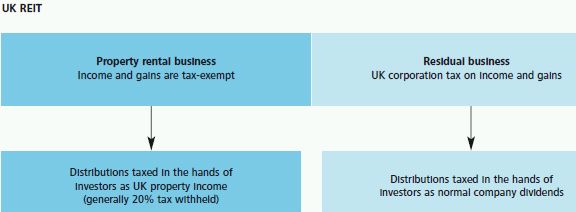

Property rental business Property rental business profits and gains are tax-exempt within the REIT itself. Tax benefits of REITs. Ability to exploit IP at favourable tax rates.

Ireland property rush risks repeat of crisis. To eliminate the double layer of taxation which typically hinders the holding of property through a company a REIT is exempt from corporation tax on qualifying profits from rental property. One of the largest REITs in Ireland with a portfolio valued at 15 billion Hibernia owns and develops property mainly of a commercial nature in the Irish Dublin market.

Here are some more benefits. Financial Benefits of REITs. Form 1099-DIV is an Internal Revenue Service form issued by a REIT brokerage bank mutual fund or real estate fund.

This allows it to benefit from exemptions from UK corporation tax on profits and gains arising from its property rental business. Accelerated tax depreciation allowances for approved energy efficient equipment. These profits are then taxed at investor level.

Irish real-estate investment trusts stand to benefit from any move by the Central Bank of Ireland to restrict non-listed property funds from offering investors access to. A 25 credit on qualifying R. Distributions to investors derived from tax-exempt rental profits.

The aim of a REIT is to provide a post-tax return for investors similar to that of direct investment in property whilst also giving the benefits of risk diversification. Form DWT Claim Form- REIT refers. Real Estate Investment Trusts REITs REITs are companies who earn rental income from commercial or residential property.

Individual REIT shareholders can deduct 20 of the taxable REIT dividend income they receive but.

Considerations For Reit Or Mlp Formation By Healthcare Not For Profit Organizations Healthcare United States

Q4 S Silver Lining Plenty Of Tax Loss Harvesting Opportunities Global X Etfs

Q4 S Silver Lining Plenty Of Tax Loss Harvesting Opportunities Global X Etfs

Quick Overview Of Irish Real Estate Rsm Ireland

Alternative Investments Ireland Tax Advantages Investors Asset Management

Can You Do A 1031 Exchange Into Reit All Section 721 Rules

How To Invest In Reits In The Uk Raisin Uk

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Real Estate Investment Trusts In Ireland

Ireland Immigrant Investor Program The Ultimate Guide 2022

Uk Reits A Summary Of The Regime Fund Management Reits Uk

Alternative Investments Ireland Tax Advantages Investors Asset Management

Educated Reit Investing The Ultimate Guide To Understanding And Investing In Real Estate Investment Trusts Wiley

The Uk S New Asset Holding Company Tax Regime Might You Be Enticed To Be Offshore No More Morrison Foerster Llp Jdsupra

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide